Know Us

Mission, vision and values

Mission

Satisfy our partners and clients with a unique purchase of quality, variety, price and service, based on the attention and commitment of our workers.

View

To be an independent, innovative, honest and sustainable cooperative in which to buy with choice and good prices. In other words, to be a benchmark business model in the distribution sector.

Values

To listen to the customers, the employees, the suppliers and to our environment, to provide products, training, information, welfare, development and sustainability, and to be responsible through commitment, honesty and respect.

"Committed workers, satisfied customers."

"To be a benchmark business model in the distribution sector."

"Listen to act as a responsible company."

Our history

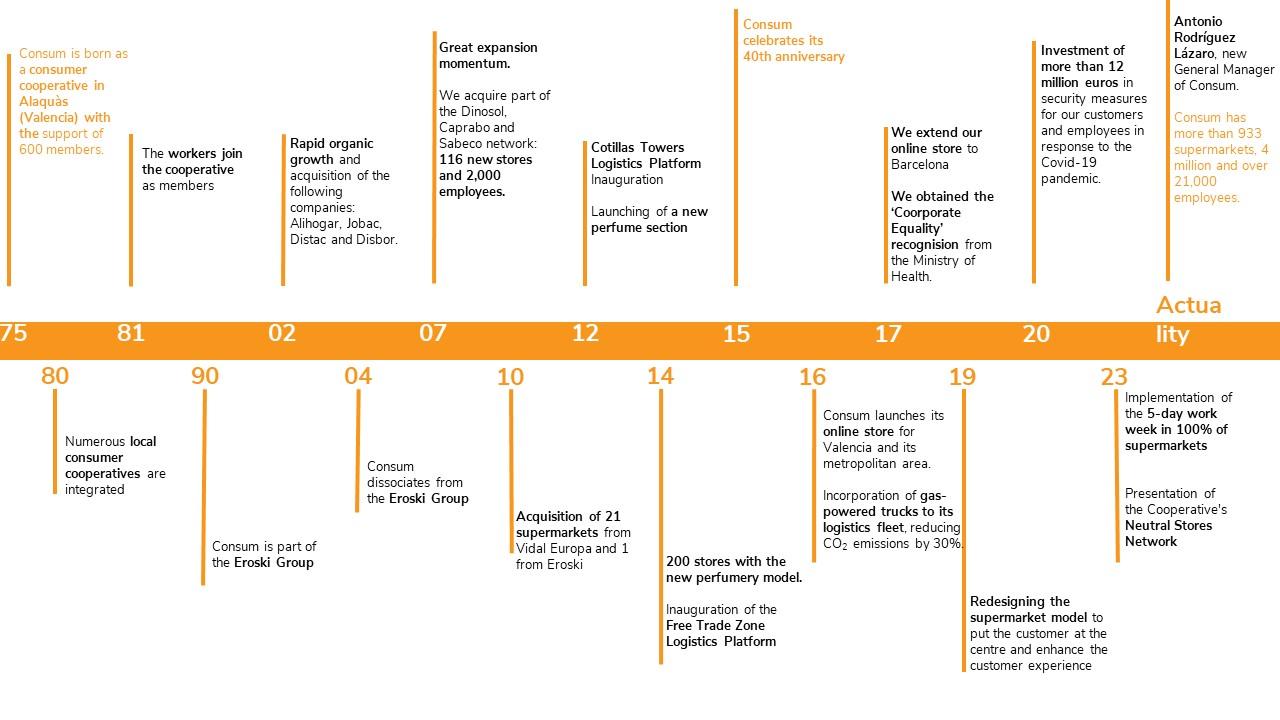

1975

The Valencian cooperative Consum started out in 1975 as a consumer cooperative, with the opening of its first establishment in Alaquàs (Valencia) and a group of 600 consumer members.

Since then, Consum has grown steadily to become the largest Spanish cooperative in terms of number of members, and one of the leading companies in the distribution sector more generally. Rapid initial growth in its commercial network and number of consumer partners quickly consolidated the core business, followed by the addition of small existing consumer cooperatives in local towns such as Silla, Enguera and L'Olleria (Valencia).

1980

In 1981, as the consumer cooperative continued to grow through new store openings and team expansion, the growing workforce was formally incorporated into the organisation as full-fledged members. This milestone marked Consum’s evolution into a multi-purpose cooperative, made up of both worker-members and consumer-members.

In 1987, the Consum cooperative changed its approach to expansion, with the acquisition of further, more sizeable distribution companies, such as Vegeva, Ecoben, Alihogar and Jobac in the Valencian Community, as well as Distac and Disbor in Catalonia.

1990-2004

The Consum Cooperative ended its commercial alliance with the Eroski Group in February 2004. This decision was motivated by differences over the evolving organizational model.

2004-2007

After leaving the Eroski Group in 2004, Consum began an ambitious expansion programme, based on organic growth (through its own supermarkets) and via the acquisition of other companies. In 2007, Consum increased its network of Consum and Consum Basic supermarkets in Catalonia with 53 Supersol supermarkets, thus consolidating its expansion in this region. That same year, the Cooperative also acquired 62 Caprabo supermarkets, distributed throughout the Valencian Community, Murcia, Castilla-La Mancha and Andalusia, reinforcing its strategic position across the Mediterranean. From that point on, the large-scale supermarket model was implemented, with free-standing stores featuring 1,500-1,800 m² of sales floor, customer parking and multiple sections, prioritising the quality of fresh produce and consumer service, in addition to new sections.

2010

In May 2010, Consum acquired 21 supermarkets from Vidal Europa and one from Eroski, continuing with its policy of organic expansion. In 2009, for the first time, the Sustainability Report obtained the highest category of certification in terms of sustainability, receiving the Global Reporting Initiative (GRI)'s A+ certificate. In 2011, Consum standardised its Responsible Food Management Profit program, thanks to which it makes food donations to hundreds of social organisations, soup kitchens and NGOs in the areas where it is established.

2012-2014

In 2012, the Las Torres de Cotillas logistics platform was inaugurated in the Region of Murcia, involving an investment of 70 million euros and creating 300 direct and 270 indirect jobs. Consum's new high-productivity automated warehouse was also launched in Silla (Valencia), representing an investment of 2.8 million euros. The new Consum perfumery section was also launched. In 2013, the second phase of the Las Torres de Cotillas logistics platform in the Region of Murcia was inaugurated, involving an investment of 20 million euros and generating 110 direct jobs. Consum's general merchandise platforms in Silla (Valencia) and Sant Boi de Llobregat (Barcelona), obtain the AENOR N certification for “Excellence in in-store service” for their client service charters. Consum is the first Spanish agri-food cooperative to obtain this certification. And in 2014, the Free Zone logistics platform was inaugurated in Barcelona, with an investment of 50 million euros and the generation of 170 direct jobs. Consum reaches 200 stores with its new perfumery section model.

2015

Consum celebrates its 40th anniversary with a commercial network of 650 supermarkets shared between Consum and its Charter franchise, a turnover of 2,121 million euros, a workforce of more than 12,433 people and more than 2.6 million partner-clients.

2016-2020

Consum launches its online store in Valencia and the greater metropolitan area. It also begins to use gas trucks in its logistics park reducing CO2 emissions by 30%. Consum implements the use of CO2 in the refrigeration systems of its eco-efficient stores. In 2017, it extended its online store to Barcelona and is recognised by the Ministry of Agriculture as the only distribution company to have its carbon footprint certified. It also obtains "Corporate Equality" recognition from the Ministry of Health. In 2019, it redesigned its supermarket model to put the customer at the center and improve their experience. In addition, it begins to install charging points for electric cars in its parking lots.

In 2020, due to the coronavirus pandemic, Consum invested more than 12 million euros in safety measures for its customers and workers. It was the first Spanish supermarket in which it was compulsory to wear a mask.

2020-2023

In 2022, Consum received a certification for the sustainability of its logistics, achieving the 3rd Lean & Green Star. The Cooperative is the only distribution company to achieve the 3 stars this year, for reducing its CO2 emissions by more than 40%.

The Cooperative’s carbon footprint has been reduced by 84% since 2015. It’s also the first company in the food distribution sector to obtain the ‘Reduzco’ seal from the Ministry for Ecological Transition (MITECO) and, for the first time in 2023, also the ‘Compenso’ seal.

Also in 2023, Consum implemented the 5-day work week for the staff of all its supermarkets. The Cooperative thus becomes the first company in the retail sector to apply this work-life balance measure in all its stores, which was first implemented in 2021. Consum has been awarded the Top Employers seal for the eleventh consecutive year, making it one of the Best Companies in Spain to work for.

News

At the beginning of 2024, Antonio Rodríguez Lázaro took over the general management of Consum from Juan Luis Durich, who retired after thirty years as head of the Cooperative.

Consum currently has more than 933 supermarkets, including its own and Charter franchisees, distributed throughout Catalonia, Valencia, Murcia, Castilla-La Mancha, Andalusia and Aragon. With more than 4 million customers and 21,216 employees, Consum is the only distribution company with the Family-Responsible Company Certificate (Efr).

Management, administration and control bodies

The main governing bodies of the Consum cooperative are the General Assembly and the Board of Governors, with an equal make-up of working partners and consumer partners.

The Ordinary General Assembly meets once a year to ratify the decisions taken by the Board of Governors regarding the management of the Cooperative and approve the annual accounts.

It is made up of 150 delegates, distributed between employees and consumers. The Board of Governors, chaired by Francesc Llobell, is composed of 12 representatives; 50% represent the proprietary workers and the other 50% the consumer partners, as independent directors.

In addition, as a body representing the working partners, there is the Social Committee, which is itself the consulting organ of the Board of Governors, and is fundamental for internal communication insofar as it relates to socio-labour issues. It is composed of 15 delegates and a President. As well as this, the Board of Governors appoints the Managing Director of the Cooperative and the Board of Directors.

This Board of Directors is made up of 10 people, headed by Antonio Rodríguez Lázaro as Managing Director.

BOARD OF GOBERNORS

President: Francesc Llobell Mas

Vice President: Lorena Mateu Primo

Secretary: María Rosa Sánchez Martínez

Deputy Secretary: Ana Isabel Cano García

Spokespeople: María Cristina Durá Valero, Gabriel Bejerano Parra, Ricardo Díaz Sánchez, Belén Caballer Oviedo, Enrique Cerezo Cebrián, Marta Lleó del Caño, Fernando Aliaga García and María Jesús Márquez Díaz.

SOCIAL COMMITTEE

President: Inma Costa Hernández

Vice President: Francisca Bayarri Soriano

Secretary: Elvira Tarazona Tarazona

Spokespeople: Juan Antonio Ramos Almansa, Laura Pastor Miguens, Santiago Mora Garrido, Nieves Faubell Valls, M.ª Ángeles Navarro Vegara, M.ª Pilar Minaya García, Beatriz Más Tarazona, Víctor Palomino Roca, Blas Ribera Francés, Yolanda Ortega Puig, Esther Fernández Grau, Rafael Díaz-Flores Sanchis, Rosa María Pacheco Ortega, Ana Belén Navarro Galera, Noelia Miranda Cámara, Jéssica Vinuesa Amador.

AUDIT COMMITTEE

In accordance with that set forth in Additional Provision Three (section 2) of Law 22/2015, of 15 July, on Accounts Audits, it is stated that t“CONSUM, S.COOP.V.” that has the equivalent duties as the “Audit Committee”, whose composition and operation is detailed here.